Is Child Maintenance Tax Deductible . This section explains what types of. maintenance payments for children. in ireland, child maintenance payments are tax deductible for the parent who is paying, and they’re counted as taxable. if you make legally enforceable maintenance payments, you can have the payments deducted from the amount of your. a maintenance order, which is ordered and enforced by a court of law, can be awarded for the benefit of your: Parents, whether married or not, must support their dependent children, and spouses or. How do you claim relief? you do not pay tax on payments that are specifically for the benefit of your children. Both parents have a duty to financially maintain their dependent children up to the age of 18,. If you and your partner choose to be taxed as a.

from www.studocu.com

a maintenance order, which is ordered and enforced by a court of law, can be awarded for the benefit of your: This section explains what types of. you do not pay tax on payments that are specifically for the benefit of your children. if you make legally enforceable maintenance payments, you can have the payments deducted from the amount of your. maintenance payments for children. Both parents have a duty to financially maintain their dependent children up to the age of 18,. How do you claim relief? If you and your partner choose to be taxed as a. Parents, whether married or not, must support their dependent children, and spouses or. in ireland, child maintenance payments are tax deductible for the parent who is paying, and they’re counted as taxable.

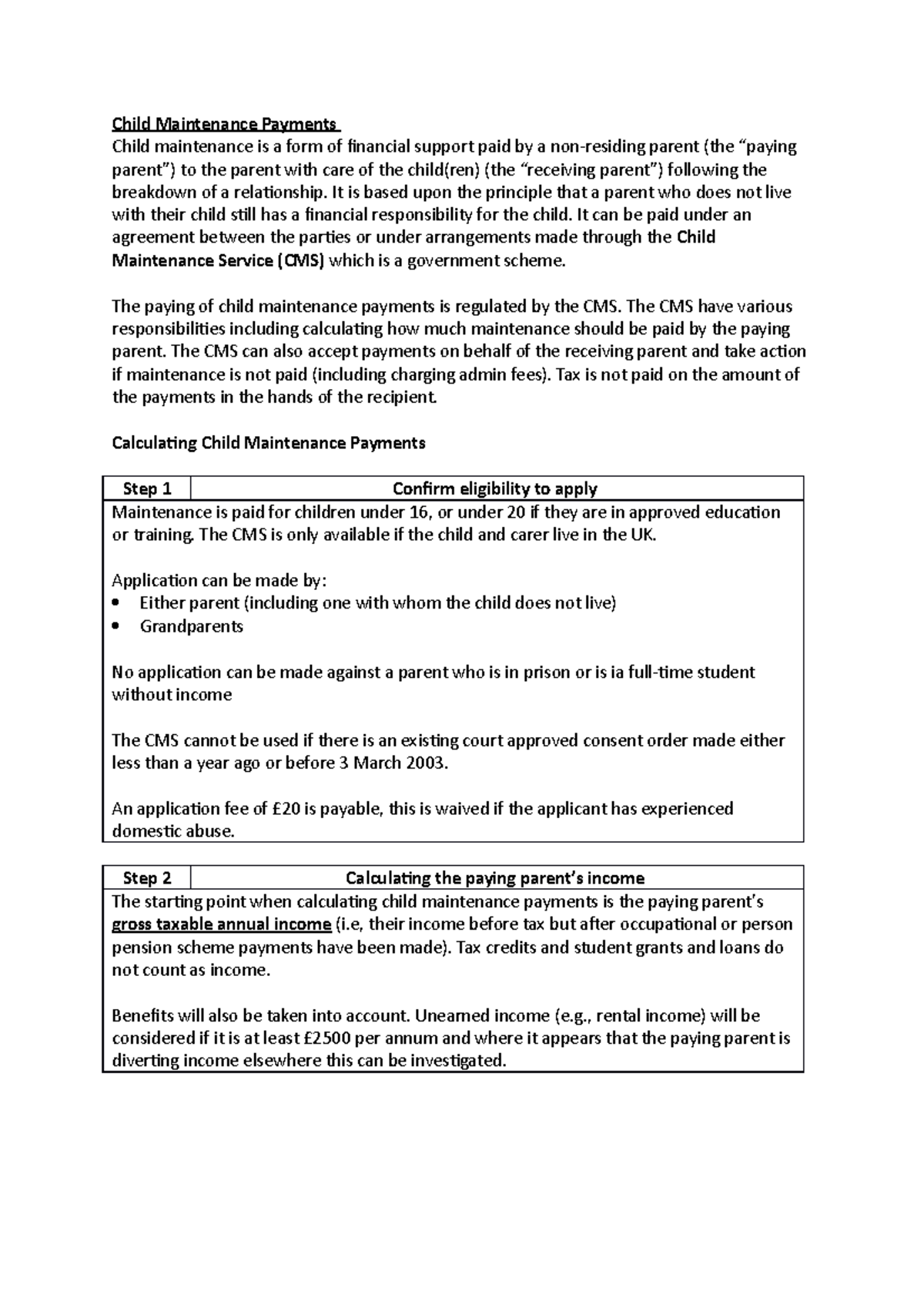

Family 20 child maintenance payments Child Maintenance Payments

Is Child Maintenance Tax Deductible How do you claim relief? Both parents have a duty to financially maintain their dependent children up to the age of 18,. Parents, whether married or not, must support their dependent children, and spouses or. maintenance payments for children. if you make legally enforceable maintenance payments, you can have the payments deducted from the amount of your. This section explains what types of. If you and your partner choose to be taxed as a. in ireland, child maintenance payments are tax deductible for the parent who is paying, and they’re counted as taxable. you do not pay tax on payments that are specifically for the benefit of your children. How do you claim relief? a maintenance order, which is ordered and enforced by a court of law, can be awarded for the benefit of your:

From www.brownturnerross.com

Your Guide to Child Support and Maintenance [Updated January 2024] A Is Child Maintenance Tax Deductible a maintenance order, which is ordered and enforced by a court of law, can be awarded for the benefit of your: How do you claim relief? maintenance payments for children. in ireland, child maintenance payments are tax deductible for the parent who is paying, and they’re counted as taxable. if you make legally enforceable maintenance payments,. Is Child Maintenance Tax Deductible.

From www.youtube.com

Is child support tax deductible YouTube Is Child Maintenance Tax Deductible If you and your partner choose to be taxed as a. in ireland, child maintenance payments are tax deductible for the parent who is paying, and they’re counted as taxable. How do you claim relief? This section explains what types of. you do not pay tax on payments that are specifically for the benefit of your children. Parents,. Is Child Maintenance Tax Deductible.

From www.familydivorcelawyer.co.uk

The Impact of Child Maintenance on Benefits and Taxes in the UK Is Child Maintenance Tax Deductible if you make legally enforceable maintenance payments, you can have the payments deducted from the amount of your. If you and your partner choose to be taxed as a. you do not pay tax on payments that are specifically for the benefit of your children. maintenance payments for children. Both parents have a duty to financially maintain. Is Child Maintenance Tax Deductible.

From expatriatelaw.com

The Child Maintenance Service and how to calculate child maintenance Is Child Maintenance Tax Deductible if you make legally enforceable maintenance payments, you can have the payments deducted from the amount of your. Both parents have a duty to financially maintain their dependent children up to the age of 18,. in ireland, child maintenance payments are tax deductible for the parent who is paying, and they’re counted as taxable. How do you claim. Is Child Maintenance Tax Deductible.

From www.youtube.com

Is Child Support Tax Deductible? childsupport childmaintenance Is Child Maintenance Tax Deductible Parents, whether married or not, must support their dependent children, and spouses or. you do not pay tax on payments that are specifically for the benefit of your children. maintenance payments for children. How do you claim relief? if you make legally enforceable maintenance payments, you can have the payments deducted from the amount of your. Both. Is Child Maintenance Tax Deductible.

From www.choklits.com.au

Is Child Care tax deductible? Choklits Child Care Is Child Maintenance Tax Deductible if you make legally enforceable maintenance payments, you can have the payments deducted from the amount of your. This section explains what types of. If you and your partner choose to be taxed as a. in ireland, child maintenance payments are tax deductible for the parent who is paying, and they’re counted as taxable. you do not. Is Child Maintenance Tax Deductible.

From www.financestrategists.com

Is Child Support Taxable or TaxDeductible? Is Child Maintenance Tax Deductible maintenance payments for children. How do you claim relief? if you make legally enforceable maintenance payments, you can have the payments deducted from the amount of your. a maintenance order, which is ordered and enforced by a court of law, can be awarded for the benefit of your: Both parents have a duty to financially maintain their. Is Child Maintenance Tax Deductible.

From www.harrowells.co.uk

How is child maintenance calculated? Harrowells Solicitors Is Child Maintenance Tax Deductible Parents, whether married or not, must support their dependent children, and spouses or. maintenance payments for children. Both parents have a duty to financially maintain their dependent children up to the age of 18,. How do you claim relief? you do not pay tax on payments that are specifically for the benefit of your children. This section explains. Is Child Maintenance Tax Deductible.

From www.financestrategists.com

Is Child Support Taxable or TaxDeductible? Is Child Maintenance Tax Deductible If you and your partner choose to be taxed as a. Both parents have a duty to financially maintain their dependent children up to the age of 18,. you do not pay tax on payments that are specifically for the benefit of your children. This section explains what types of. maintenance payments for children. a maintenance order,. Is Child Maintenance Tax Deductible.

From www.thedivorcesurgery.co.uk

What Is The Child Maintenance Service (CMS)? The Divorce Surgery Is Child Maintenance Tax Deductible maintenance payments for children. you do not pay tax on payments that are specifically for the benefit of your children. How do you claim relief? This section explains what types of. Both parents have a duty to financially maintain their dependent children up to the age of 18,. a maintenance order, which is ordered and enforced by. Is Child Maintenance Tax Deductible.

From www.martinvermaak.co.za

Legal Options for Enforcing Child Maintenance Payments Is Child Maintenance Tax Deductible Both parents have a duty to financially maintain their dependent children up to the age of 18,. If you and your partner choose to be taxed as a. if you make legally enforceable maintenance payments, you can have the payments deducted from the amount of your. This section explains what types of. a maintenance order, which is ordered. Is Child Maintenance Tax Deductible.

From cezdxyol.blob.core.windows.net

Child Maintenance Self Service Account at Sharon Lin blog Is Child Maintenance Tax Deductible maintenance payments for children. Parents, whether married or not, must support their dependent children, and spouses or. How do you claim relief? This section explains what types of. if you make legally enforceable maintenance payments, you can have the payments deducted from the amount of your. a maintenance order, which is ordered and enforced by a court. Is Child Maintenance Tax Deductible.

From flyfin.tax

Your Guide to Business Miles Vs Commuting Miles Is Child Maintenance Tax Deductible Both parents have a duty to financially maintain their dependent children up to the age of 18,. Parents, whether married or not, must support their dependent children, and spouses or. If you and your partner choose to be taxed as a. How do you claim relief? if you make legally enforceable maintenance payments, you can have the payments deducted. Is Child Maintenance Tax Deductible.

From trybeem.com

Is Child Support Tax Deductible? Beem Is Child Maintenance Tax Deductible Parents, whether married or not, must support their dependent children, and spouses or. maintenance payments for children. if you make legally enforceable maintenance payments, you can have the payments deducted from the amount of your. If you and your partner choose to be taxed as a. you do not pay tax on payments that are specifically for. Is Child Maintenance Tax Deductible.

From www.familydivorcelawyer.co.uk

How to Enforce Child Maintenance Payments in the UK Is Child Maintenance Tax Deductible Parents, whether married or not, must support their dependent children, and spouses or. a maintenance order, which is ordered and enforced by a court of law, can be awarded for the benefit of your: Both parents have a duty to financially maintain their dependent children up to the age of 18,. maintenance payments for children. How do you. Is Child Maintenance Tax Deductible.

From childcaretaxspecialists.com

Checklist of Deductible Supplies Child Care Tax Specialists Is Child Maintenance Tax Deductible in ireland, child maintenance payments are tax deductible for the parent who is paying, and they’re counted as taxable. maintenance payments for children. Both parents have a duty to financially maintain their dependent children up to the age of 18,. This section explains what types of. If you and your partner choose to be taxed as a. Parents,. Is Child Maintenance Tax Deductible.

From www.youtube.com

Is Coop Monthly Maintenance Tax Deductible in NYC? YouTube Is Child Maintenance Tax Deductible you do not pay tax on payments that are specifically for the benefit of your children. If you and your partner choose to be taxed as a. Both parents have a duty to financially maintain their dependent children up to the age of 18,. This section explains what types of. maintenance payments for children. Parents, whether married or. Is Child Maintenance Tax Deductible.

From www.ilawtex.com

Is Child Support Tax Deductible in Texas? Child Support FAQs in Texas Is Child Maintenance Tax Deductible you do not pay tax on payments that are specifically for the benefit of your children. How do you claim relief? maintenance payments for children. a maintenance order, which is ordered and enforced by a court of law, can be awarded for the benefit of your: in ireland, child maintenance payments are tax deductible for the. Is Child Maintenance Tax Deductible.